MONEY MANAGEMENT SKILLS FOR YOUNG ADULTS FREE

Lifeskills Maths is the application of Mathematical skills in real life contexts. Free course Managing my money for young adults Free statement of participation on completion Course description Course content Course reviews The course takes no more than 24 hours of study with learners typically completing it in 12 to 16 hours. The National Autistic Society has an online module designed to help autistic people manage their money.īBC bitesize also has a range of topics on managing money under the Lifeskills Maths section. There is a guide for talking to teenagers about money. They have a section called Family and Care which will help parents teach the vital skills of understanding and using money effectively. It puts you in control with impartial guidance that’s backed by government and to recommend further, trusted support if you need it. It helps to explain what you need to do and how you can do it. MoneyHelper tries to make your money and pension choices clearer.

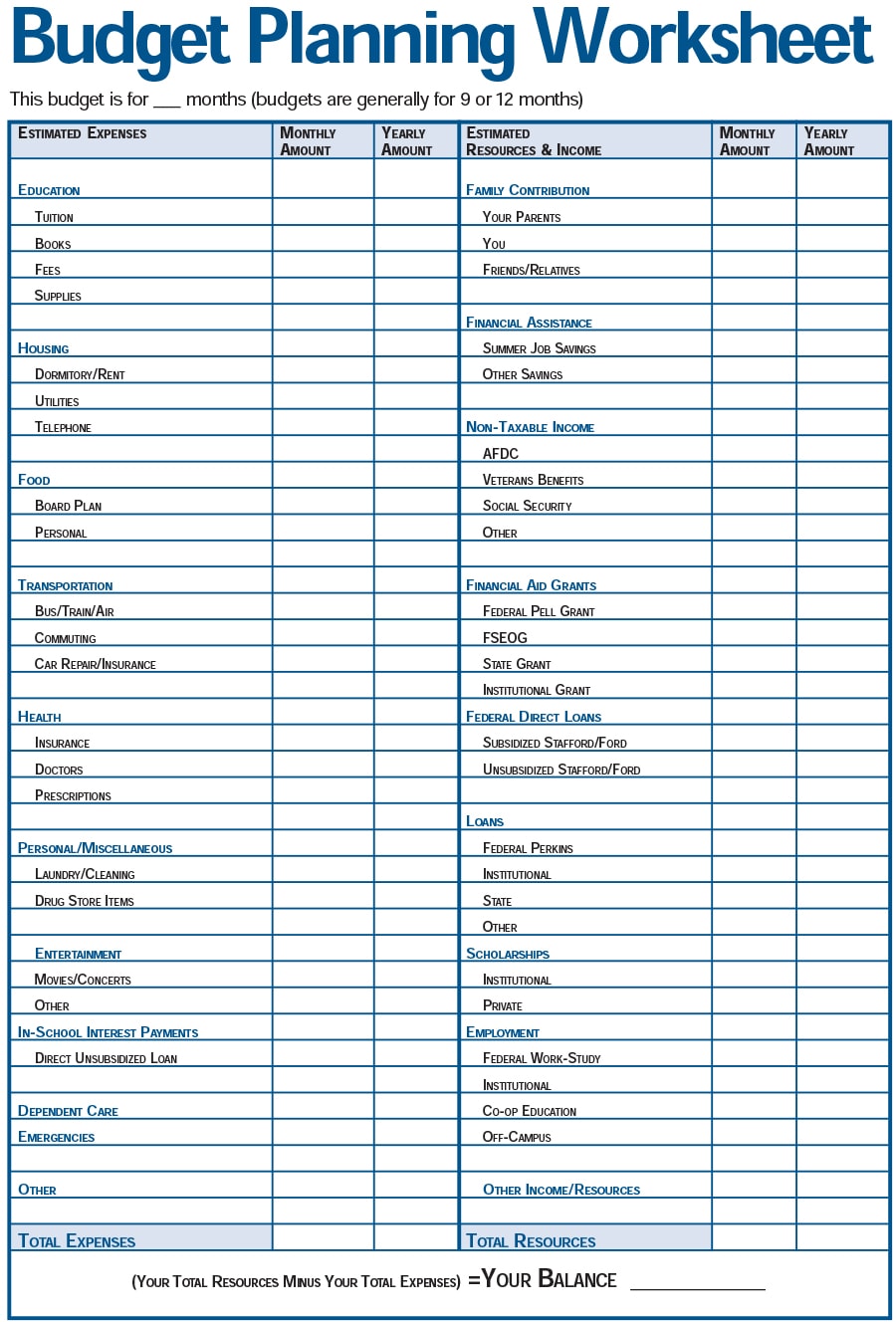

Their financial toolkit has resources like worksheets for tracking weekly spending, building budgets, vetting banks and creating shopping lists. Personal money management skills include budgeting, wise use of credit. The following websites offer useful information: According to the National Disability Institute, people who have disabilities must build healthy money habits just like anyone else. Saving and asset building are the cornerstones of sound financial planning. Share how you budget with your child on items such as weekly food cost, household bills and travel.Ī meal credit card scheme is often in schools to stop carrying cash but if this card is frequently lost or forgotten try attaching it to a retractable chain. Review this on a monthly basis so they have had to manage it across the whole month.

MONEY MANAGEMENT SKILLS FOR YOUNG ADULTS HOW TO

Having a bank account can teach how to manage saving and spending. On shopping trips encourage your child to take their items to the counter, pay in cash and receive change.īy secondary school age, children want to be more independent in managing their money and spending their money.Open a bank account - many branches have kid friendly accounts.Chat about pocket money and what this can buy andwhat it won’.Match coins up to the sheet attached to the drawings of coins.Practice with your child at home using pretend shops, toy till and coins from the “change box”.School will cover budgeting and money matters within the curriculum but there are lots you can do at home too: When out and about give opportunities to let your child pay for items, to look at the costs of things. At home give lots of opportunities to practise with money, talk about money and costs of things.

Difficulties can arise due to poor organisational skills or difficulty doing calculations under pressure. Understanding of money, budgeting and saving are important life skills.

0 kommentar(er)

0 kommentar(er)